California-based toyco Mattel is feeling the impact of the costs associated with its recent US$680-million acquisition of UK kids entertainment company HIT Entertainment, reporting lower first quarter earnings in its latest financial results.

Quarterly profits fell 53% from US$16.6 million (five cents per share) a year ago to US$7.8 million or two cents per share, which includes the negative impact of four cents per share from HIT Entertainment acquisition and integration costs. Cash flows used for investment activities were approximately US$703 million, a rise of $694 million, driven primarily by the acquisition of HIT.

Global sales of US$928.4 million dropped 2% compared to US$951.9 million last year.

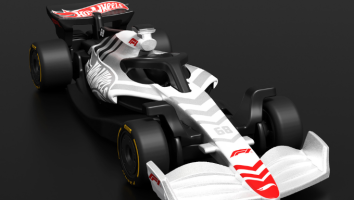

Within the girls and boys brands business, global sales were US$622.2 million, a decline of 4% versus a year ago. While hit girls brand Monster High buoyed worldwide gross sales for the other girls brands category driving the category up by 22%, global gross sales of Barbie and worldwide sales of the wheels category (Hot Wheels, Matchbox and Tyco R/C) were both down by 6%. The 17% sales decline within the entertainment business, which includes Radica games and puzzles, was largely driven by decreases in sales of merchandise based on Disney/Pixar’s Cars.

Within the Fisher-Price business unit, global sales remained flat at US$310.2 million versus a year ago, and sales of American Girl brands rose by 4%.

Regionally, gross sales fell 9% in the North American region and sales increased 7% internationally.